Table Of Contents

LIXT Stock: A Brief Guide

Stock is a very interesting area where people invest with the expectation of higher returns. In simple words, the stock is an ownership equity in a firm. And it gives the shareholders to claim corporate earnings and gives voting rights. If you are investing in stocks, then you will get dividends and capital gains. There are both institutional and individual investors who come together to buy and sell shares in a public venue.

In this article, we will talk about LIXT stock. Investing in stocks is tricky. There are people who have experience in investing in stocks, but they still don?t know which one has the most potential to give them the highest return.

LIXT Stock: Company Profile

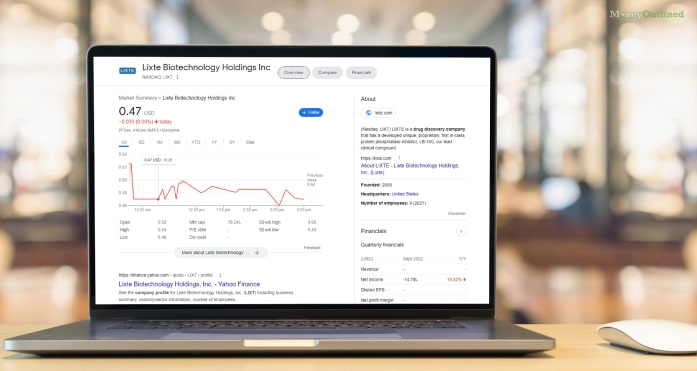

Before investing in stocks, the first thing is to know about the company behind them. Because the company is the reason how the stock works in the market. The company behind LIXT stocks is Lixte Biotechnology Holdings Inc. This is a drug discovery company. The company identifies enzyme targets that cause serious common diseases. It uses biomarker technology to identify the enzymes. And then create compounds that can cure the diseases.

The main focus of the company is the inhibitors of protein phosphates. When protein phosphates combine with cytotoxic agents, immune checkpoint blockers, and X-rays, there are two major categories of compounds that come from it. The compounds are then used for clinical and pre-clinical development. And through this process, there is a drug that develops.

First of all, there is the LB-100 series, which is used for cancer, and metabolic and vascular diseases. The second drug is the LB-200 series. This drug is famous for treating chronic hereditary diseases such as Gaucher?s disease. The drug is also used to treat neurodegenerative diseases and cancer.

There is also a clinical trial research agreement between Lixte Biotechnology Holdings Inc. and Moffitt Cancer Center and Research Institute Hospital Inc. This is a collaboration agreement for an initiated clinical trial. And the agreement is with the Spanish Sarcoma Group. And there is also Netherlands Cancer Institute and Oncode Institute that is incorporated. The company is based in Pasadena, California, and started in 2005.

The key people of the company are as follows.

- Robert B. Royds and John S. Kovach (Founders)

- John S. Kovach MD (Chairman, President, and Chief Executive Officer)

- Eric J. Forman (Vice President and Chief Operating Officer)

- Robert N. Weingarten MBA, CPA (Vice President and Chief Financial Officer)

- Gin N. Schwartzberg, Regina Brown, and Yun Yen MD, Ph.D. (Independent Director)

LIXT Stock: Financial Health

You should have a look at this list.

| EPS (Fiscal Year) | $0.46 |

| Net Income | $-6,730,000.00 |

| Return on Assets | -111.58% |

| Return on Equity | -328.68% |

| Quick Ratio | 16.71 |

| Current Ratio | 16.71 |

| Book Value | $0.09/share |

| Free Float | 11,786,000 |

| Outstanding Shares | 16,650,000 |

| Market Cap | $8.33 million |

| Beta | -0.65 |

LIXT Stock: Important Things To Know

As you are already aware of the basic information about the company. There are also some important things that you should know, and the information will help you to decide whether you should invest in this stock or not.

Key Competitors

The company focuses on drug development. But, there are already other companies existing in the market. The main competitors of Lixte Biotechnology are Vipax Pharmaceuticals, Bellerophon Therapeutics, RedHill Biopharma, Chembio Diagnostics, and NeuroBo Pharmaceuticals. And these companies are at the top of the market.

Who Are The Insiders?

Other than key people of the company, you must know who the insiders are and how much they own. There are mainly three people who are at the top. They are Rene Bernards, Eric Forman, and Regina Brown. They are the major shareholders.

Earnings in the Last Quarter

The company released its last quarter?s income on November 4th. And they showed that the company earned $0.01 per share.

Lixte Biotechnology IPO

The company was successful in raising $7 in its first initial public offering. There were a total of 1,500,000 shares, and the price was $4.75 per share.

Market Capitalization

According to various sources, the company has a market capitalization of $8.32 million. And the company was at a loss as it earned $-6,730,00.

? Lixte Biotechnology Contact

? Mailing Address- 248 Route 25A No.2, East Setauket NY, 11733

? Official Website- www.lixte.com

? Phone Number- (631) 830-7092

? Email- info@lixte.com

? Fax- 631-982-5050

Frequently Asked Questions (FAQs):-

Here are some interesting questions and answers that you should read.

Ans: On January 1st, 2022, the stock was trading at a price of $1.19. And that was the highest price of LIXT stocks in 2022. Since then, the decrease rate of the stock has been 58%. And now, the LIXT stock price is trading at $0.50.

Ans: The last time Lixte Biotechnology saw an increase was in the month of November. The report says that there is a total of 50,900 shares in the short interest. And the increase was around 53.3%. On November 15, the total number of shares was 33,200. So, if we calculate the average volume, there are a total of 27,700 shares, and the short-interest ratio is 1.8 days. So, around 0.7% of shares are sold.

Ans: Typically, the company releases its earnings every quarter. So, according to the last time the company released the data, the next quarterly earnings announcement will be on March 20th, 2023. That is a Monday.

LIXT Stock: Our Verdict

So, I hope now you have a complete idea about LIXT stock. Now the question is, should someone invest in the stocks or not?

If you want a quick return by investing in the LIXT stock, then forget about it. But, experts say about LIXT stock forecast is that the stock will give you a high return in the long term. So, if you have some extra money, then invest. If you want to trade, then I don?t think that it is a good option.

If you have any queries, feel free to ask in the comment section below.

Thank You.

Have A Look :-

Leave A Comment