Table Of Contents

Salary Vs. Hourly Pay: What Is The Difference?

Compensation matters when you are switching jobs. It not only helps in negotiating prices but also gives you an insight into payment options. On getting hired for a position, your employer is most likely to pay you as a salaried employee or an hourly one. But how will you know the differences between salary vs. hourly pay?

To address such issues, I have crafted this comprehensive guide. It will walk you through the definitions, differences, and various aspects of salary and hourly pay. So, make sure you read it till the end and make an informed decision on which suits your needs better.

Definition Of Salary vs. Hourly Rates

An hourly rate is the earnings of an individual for each hour spent working. You must receive payment for all the hours you operate as an hourly employee. In case the employer wants you to work extra time, they will have to give you more money.

Take, for instance, if you function 24 hours and 30 minutes, the employer will pay you for 24.5 hours. However, if you have an hourly charge of $18, you will receive $441 for the completed time.

On the other hand, salary refers to a consistent payment made to any employee on the basis of his full-time position. Usually, employers distribute salaries on a bi-monthly or monthly basis. However, there are certain businesses paying annual salaries. The frequency, as well as the payment amount, is clearly stated in your employment contract.

Unlike hourly pay, the salary is usually fixed. For instance, you receive $5,000 every month before taxes which makes $60,000 every year. This becomes your gross pay.

In the debate of salary vs. hourly pay, most individuals tend to prefer the former as it is a stable payment. As far as salary is concerned, large employers have a preset salary range for every employee.

Read More: Financial Tips: Outline Personal Finance Using These Financial Tips

Salary vs Hourly Pay: Underlying The Differences

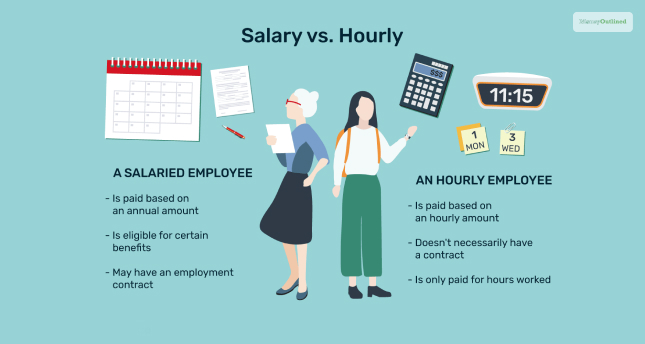

Being a salaried employee is largely different than being an hourly paid employee. Let?s check out their differences below:

1. Differences In The Employment Type

You know you are a salaried individual when you are paid a preset income, irrespective of how long you work inside the office. The salary is a clear depiction of the gross amount every employee receives annually. Instead of an hourly rate, the employee receives installments all through the year. 99% of companies pay salaries to employees every month.

Salaried individuals almost operate in full-time roles and possibly receive organizational benefits as compared to their hourly counterparts. Benefits might include paid time off, medical insurance, a dedicated desk space, etc. If you are a salaried employee, you will not be paid for overtime hours unless your employer chooses to.

On the other hand, being an hourly employee means you will be paid according to the number of hours you operate. Hourly workforce are not considered ?exempt? as they can perform overtime as and when they want. The employer has a little role to play here.

The pay of an hourly employee fluctuates significantly, and it depends on their schedule set. This schedule is generally set by their employer. In certain work settings, hourly employees might also have to use a clocking-in system or timesheet to track their operation hours.

2. Differences In Calculating Salary vs Hourly Pay

If you want to compare your hourly pay with that of a salaried employee, you will first have to convert your hourly wage into FTE. Full-time equivalent or FTE is basically a unit that calculates how many salaried individuals can work for one or more hourly workers.

Take, for instance, an hourly individual functioning half as many hours as one full-time employee will have 0.5 FTE. When you track workers using this simple metric, you get a better understanding of labor costs. Additionally, it becomes easier to plan new hires and fix their compensation.

There is an easy way for employees to convert their annual salary into an hourly rate. Just divide your gross pay by 52. Whatever the result is, multiply it by the weekly numbers and again by the working hours of a week. However, if you want to do the exact opposite, reverse the process. Multiply the rate by your operational hours and finally by 52.

Finally, this method of calculation is not applicable for fringe benefits or overtime rates, including PTO.

Perks Of Hourly Pay Vs. Salary Pay

Here comes the most awaited part of my article. I know you are curious to unravel the benefits of salary vs. hourly methods of payment. So, shall we begin? Let?s get started!

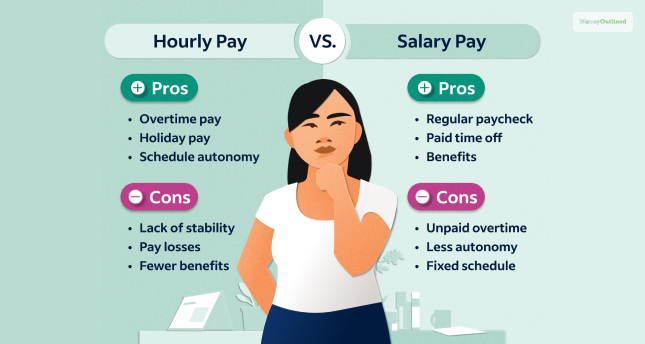

| Benefits Of Salaried Employees | Benefits Of Hourly Employees |

|---|---|

| First things first, salaried individuals are more likely to acquire health and dental insurance. Also, this is not limited to just them; family members are also covered under this insurance. | Since an hourly employee receives payment for the exact number of their operational hours, chances are they will receive an extra amount. The only condition is they will have to work for extra time. |

| Secondly, a salaried employee is liable to receive the benefits of parental leaves. Paid parental leave consists of multifold advantages and this is why more cities are mandating that every employer should offer them. | Further, you get the freedom to work from wherever you want. You do not have to visit the office space and sit in the same cubicle. An hourly employee usually works remotely, working in the comfort of their desired place. |

| A lot of companies also provide a 401(k) plan to their employees, which is basically an employer-sponsored retirement plan. This allows workers to add scheduled pre-tax contributions to their savings dedicated to retirement. | Generally, an hourly employee gets much time for other activities as they don?t have to commute. An enhanced work-life balance exists when you are working as an hourly individual. They are typically free to set some time aside for their favorite hobbies. |

| Moreover, a salary has the biggest perk of being a stable income source. An employee has the complete liberty to budget his future as they are well-aware they will be paid the same amount of money for a continuous period. | Finally, these individuals are not limited to a single employer. This means they can accept as many offers as they want. As a result, they get a broader breadth of experience, endless contacts, and also a degree of financial security. |

Read More: How To Start A Business In Less Budget ? A Complete Guide

And It’s A Wrap?

With this, I rest my opinions on salary vs. hourly pay. But you still have the homework of figuring out which type works best for you. Comprehending the benefits and aspects of both hourly and salary pay might help you make an informed decision. After all, it?s the pay that ultimately matters!

As for employers, you must make sure your employees are rightly compensated, either salary or hourly. While salaries give an employee stability, hourly pays have much more value when it comes to money.

So, that was all about it. Let us know which one you would prefer in the comment box below.

Read Also:

Leave A Comment