Table Of Contents

- Steps To Void A Check

- Situations When A Void Check Is Used

- For Setting Up Direct Payments

- In Case Of Direct Deposits

- Usual Bill Payments

- What To Do When Somebody Doesn?t Use Checks?

- Utilize a deposit slip

- Submit Online Banking Information

- Request A Starter Check From The Bank

- Ask Your Bank For Other Documents

- Frequently Asked Questions!! (FAQs)

- Conclusion

- Steps To Void A Check

- Situations When A Void Check Is Used

- For Setting Up Direct Payments

- In Case Of Direct Deposits

- Usual Bill Payments

- What To Do When Somebody Doesn?t Use Checks?

- Utilize a deposit slip

- Submit Online Banking Information

- Request A Starter Check From The Bank

- Ask Your Bank For Other Documents

- Frequently Asked Questions!! (FAQs)

- Conclusion

How To Void A Check: A Comprehensive Guide

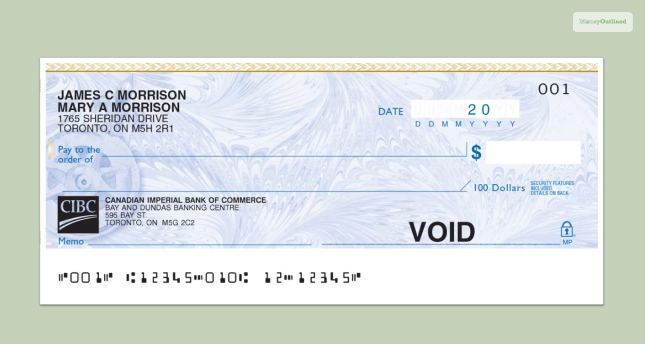

Creating financial transactions for personal use, like digital bill pay or paycheck deposits, often requires a voided check. The term ?VOID? has to be mentioned in the check, written across it, and determined that it can?t be used for making payments.

In order to gain an idea of how to write a void check, you will have to go through a series of steps. A void check consists of all pertinent information related to banking. A maximum of 55% of the population prefer paying bills online.

It marks a necessary setup when you are dealing with financial transactions. Let?s know more about it in this informative guide.

Steps To Void A Check

Given below are some steps to void a check. Have a look at them:

- Take a pen, not a pencil, as someone can easily take advantage and write erase your void check. Always bring in a blue or black marker. The most significant thing is to ensure that it cannot be obscured or erased in any way.

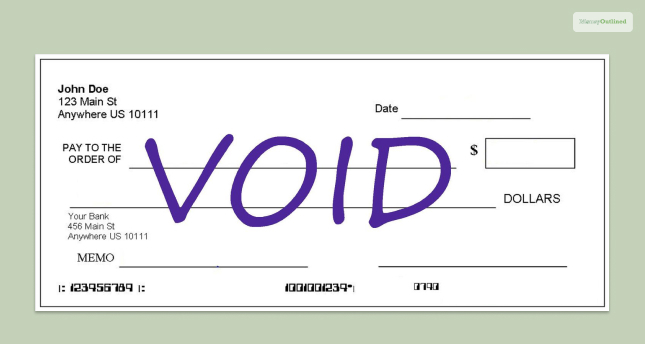

- If you want to void a check you still possess, the process is not very complicated. All you have to do is fill the check with ?void? in various places to let the reader know that it is no longer usable. Moreover, the payee line is where you fill in who this check is written for.

- Thirdly, you might want to use the payment amount box to note down ?VOID.? The box on the right is where you normally note down the check?s value. If an amount is written on it already, make sure you write VOID in it clearly.

- If you want to discover things like how to write a void check for direct deposit, you will have to write the term in the signature box. Your ?void? should be in big letters all across the check, and ensure you do not leave any opportunity for fraudsters.

Situations When A Void Check Is Used

The next portion of the article focuses on different situations when a void check is used. Check them out:

For Setting Up Direct Payments

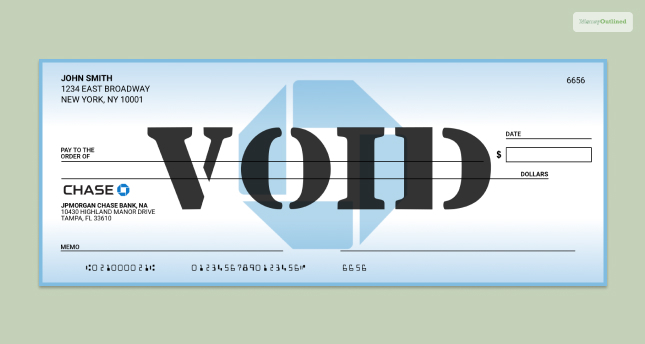

A voided check might be necessary when scheduling an electronic payment; it can be for business or personal purposes. For instance, if you own a business where your vendors prefer online payment, voiding a check can help in setting up automatic payments.

In Case Of Direct Deposits

Among all forms of deposit, direct deposit helps you get quick payments. However, your employer requires certain data from where you get started. When you want to get insight into how to write a void check, you must first learn about your bank routing number. Providing these details becomes simpler with a voided check.

Usual Bill Payments

You might deposit a voided check when you wish to pay your car loan, mortgage, and other online bills. This will ensure payment schedule from your bank account. Remember that voiding a check is necessary if you write a check and make a mistake.

What To Do When Somebody Doesn?t Use Checks?

Checks are not available on every checking account. For instance, Chase is a leading bank that offers checkless checking. Such accounts might allure underbanked as well as unbanked individuals, who are just 18.7% and 5.4% of the population, respectively. You might try the following options if your checking account does not offer checks.

Utilize a deposit slip

In case you don?t have an idea of how to write a void check online, you can try a deposit slip instead. However, it must consist of your bank account number and routing number. This option is applicable only if your bank allows it.

Submit Online Banking Information

When you are trying to process online bill payments, it might be possible through digital banking access. Also, there is no requirement for a voided check or a paper form.

Request A Starter Check From The Bank

Your bank might be liable to print you a sample or starter check with your routing number. You may use the same for voiding purposes.

Ask Your Bank For Other Documents

If there is no use of a starter check or a deposit slip, you can request your bank to provide you with documents. This can be an official letter with your bank?s account and routing number. When you want to use a voided check but can?t, these can be a great alternative.

Frequently Asked Questions!! (FAQs)

Ans. Employers usually make use of a voided check for setting up direct payments for their payroll. On the other hand, service providers need them to automate direct debits. They are usually well aware of how to write a void check. This is due to a blank check that consists of complete data from routing numbers to the payee?s account number.

Ans. First of all, depositing a voided check is fairly impossible. However, there might be instances when you can deposit the check in an ATM. An erroneously cleared fund will be eliminated from the recipient?s bank. On clearing a voided check, consumers can claim while receiving their statement.

Conclusion

Making use of a paper check can sometimes be risky as they contain sensitive banking information. Hence, knowing how to write a void check safely is important to avoid it falling into the wrong hands. After voiding it, make sure to either deposit it or keep it aside from other files.

Ultimately, a check that has been voided comes in handy in various situations. All you have to do is know the precise method of voiding it to ensure smooth payment.

Thank you for reading our article on void checks. We hope it helped you walk through the important transaction steps. Use the comment section below and communicate your thoughts.

Explore More:

Leave A Comment