Table Of Contents

What Is Index Funds? How To Invest In It?

“Don’t keep all the eggs in the same basket.”

If you have been investing for some time, you may have come across this line. Diversification is a widely practiced way to minimize the risk of losing wealth in the stock market.

Investors often spread their money across different platforms like stocks, mutual funds, bonds, gold, and other assets. This way, they can minimize the risk of losing their money.

Once you are in the whirlpool of the share market, you may have also come across another term called an Index fund. In the following article, I have explained what index funds are and how to invest in them.

What Are Index Funds?

Index mutual funds are a type of mutual fund. These funds have a portfolio made to follow and track the elements of a financial market index. For example:

- The S&P 500 Index.

- The Russell 2000 Index.

- Wilshire 5000 Total Market Index.

This type of investment returns broad market exposure, low portfolio turnover, and low operating expenses. An index fund does not care about the condition of the market. It follows its benchmark regardless of the market’s condition. People making investment portfolios as retirement plans can benefit from the index funds.

It is the perfect and diversified holding for stock investments. Even master investors like Warren Buffett recommend investment through index fund portfolios.

Key Highlights: It is a stock portfolio that follows and imitates the composition and performance of a financial market index. They have lower fees and expenses compared to actively managed funds. This type of fund follows a passive investment strategy. Such portfolios usually outperform other types of portfolios.

How Does An Index Fund Work?

Index fund management is a type of passive fund management. The portfolio manager of an index fund does not have to manually pick the stocks or strategize the time to buy or sell them. Instead, they create a portfolio, the holdings of which follow/imitate the securities of a specific index.

The idea behind such investment is to mimic the performance of a broader part of the stock market. Almost every financial market has an index and an index fund. For instance, in the US, the S&P 500 is the most popular index widely followed. The NSE Nifty and the BSE Sensex are some other examples.

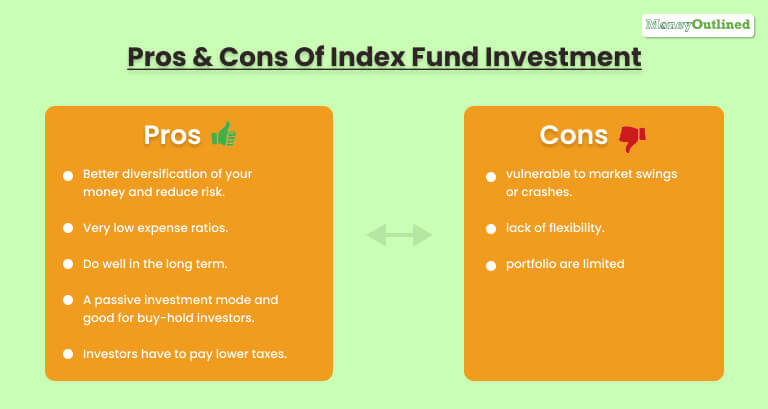

Pros & Cons Of Index Fund Investment:

Before you start putting your money in an index portfolio, you should know the pros and cons of this investment:

Pros

- Index funds allow better diversification of your money and reduce risk.

- Very low expense ratios.

- Index funds do well in the long term.

- It is a passive investment mode and good for buy-and-hold investors.

- Investors have to pay lower taxes.

Cons

- This kind of investment is vulnerable to market swings or crashes.

- There is a lack of flexibility.

- The gains in such a portfolio are limited.

Facts To Consider Before Index Fund Investment:

Now that you have decided to invest in stock through an index fund portfolio, there are a few things to keep in mind. Here are the facts you must understand and consider:

1. Understanding Risk

Of Course, the risk involved in index fund investment is lower compared to actively managed funds. Since the index fund follows the market index, the risk is minimized, and the return is usually good. But, experts often recommend mixing or switching your investment to actively managed funds during a slump.

An ideal fund would be a mix of index funds with actively managed funds. This helps reduce risk while helping the investor earn the highest possible.

2. Expense Ratio

The expense ratio is an important fact to consider during an investment. It is a tiny percentage of the total assets that the fund house charges. Thankfully, the expense ratio in index funds is lower and makes the portfolio more profitable.

3. Investment Strategy Of the Investor

The intent of the investor and their expectation in a certain period of time must comply with the mode of investment they choose. Therefore, if index funds match your needs in a specific period, you must consider it an option.

4. Tax

There are two types of taxes associated with index funds. Dividend distribution tax and capital gain tax. When choosing this type of investment portfolio, you must consider the taxes that you need to pay.

Frequently Asked Questions (FAQs):

I hope that the sections helped you understand index funds. However, for any further queries, you may check the following questions and their answers:

An index fund is a type of mutual fund with a portfolio made to track and follow the benchmark index (for instance, the Nasdaq 100 or the S&P 500). By investing in index funds, investors can invest in all the companies that make up a specific index. It offers the benefit of diversifying a stock.

Investors trying to diversify their funds can invest in index funds. If you are looking for examples, here are some of them:

? The S&P 500 Index.

? The Russell 2000 Index.

? Wilshire 5000 Total Market Index.

Investors who seek an assured return from their investment can use index funds to diversify their funds. It is a very smart investment move, and investors can diversify their stock through a very smart and affordable medium. Index funds return higher returns compared to other types of funds.

The simple answer is that the index fund is a mode of passive investment that tracks all the assets included in a particular index. This type of fund does not follow an active market investment method. It holds the same asset in the same proportion as in the index.

Final Words

Index funds also have fees. But the fees are negligible; most of the funds charge fees as minimum as 0.20%. Of Course, a diversified stock is better if the investor is planning to hold it in the long term. When diversifying, doing it through the best index funds is the best.

I hope that you got your answers from this article. Do you have any more questions? In that case, you can leave a comment.

#Disclaimer: The information provided on this blog is for educational and informational purposes only and should not be construed as financial advice. I am not a licensed financial advisor. Any investment decision you make is at your own risk, and you should consult with a qualified financial advisor before making any investment decisions. This site may contain affiliate links, and I may earn a commission at no additional cost to you.

Read Also:

Leave A Comment