Table Of Contents

- What is Direct Taxation?

- What are the main characteristics of Direct taxes?

- Non-shift ability

- The principle of ability-to-pay

- The contradiction of indirect taxes

- Which situation is an example of direct taxation?

- Income tax

- Property tax

- Estate tax

- Gift tax

- Examples Direct Taxation

- Income tax

- Property Tax

- Corporate Tax

- Estate Tax

- Gift Tax

- Sin Taxes

- Conclusion

- What is Direct Taxation?

- What are the main characteristics of Direct taxes?

- Non-shift ability

- The principle of ability-to-pay

- The contradiction of indirect taxes

- Which situation is an example of direct taxation?

- Income tax

- Property tax

- Estate tax

- Gift tax

- Examples Direct Taxation

- Income tax

- Property Tax

- Corporate Tax

- Estate Tax

- Gift Tax

- Sin Taxes

- Conclusion

Understanding the Role of Taxes in the Cost of Living Across the U.S.

The cost of living often varies based on different regions. Even in the United States, from the busy cities to quiet country roads, their daily living is often impacted by the financial realities.

The US population gets heavily impacted by factors such as transportation costs, housing expenses and groceries.

However, Tax is the only one factor which goes unnoticed. Before planning for any cost of living or look for places with better affordability, if is necessary to understand the significant difference between direct and indirect taxes.

Once you ace the understanding, it will be easy for you to find a better place for you to move in where the cost of living is decent or the impact of taxation is less.

In this article, let’s explore the different examples of direct taxation in the United States. I will also explain taxation’s impact on the cost of living across the U.S. and help you understand which situation is an example of direct taxation.

What is Direct Taxation?

A direct tax is mainly paid by a person or organization directly to a specific entity that imposed the tax.

Income tax, personal property tax, and real property tax are some of the prime examples of taxes. Individuals pay these taxes directly to the government or related organizations.

So, basically when you are paying your income tax to the government, it means you are paying direct tax.

The idea of indirect tax opposes the concept of direct tax. Here, you pay for the tax that has been levied on the seller.

Several taxes such as income tax, property tax and gift tax are considered as direct tax.

So, you can say you will be the bearer of the tax as it falls directly on the payer.

What are the main characteristics of Direct taxes?

In 1913, during the 16th Amendment to the U.S. Constitution, the difference between direct taxes and indirect taxes was proposed. Before the Amendment, direct taxes were always paid directly to the state’s population.

However, during the 16th constitutional Amendment, the U.S. changed its definition and sanctioned direct and indirect taxes.

Direct tax has some significant characteristics that help distinguish it from other taxes. Here are the characteristics:

Non-shift ability

In the case of direct taxes, you cannot pass the entity on to another person. Only the person or organization on whom the tax has been imposed is highly responsible for paying the tax.

The principle of ability-to-pay

The direct tax is always designed based on the ability-to-pay principle. But what does this mean?

The ability-to-pay principle allows government bodies to impose taxes based on their resources. So, if you have more resources, you will have to bear a greater tax burden. On the other hand, the ones with fewer resources will have to bear less.

However, there is an argument among the critics about the ability-to-pay principle.

According to them, the principle can discourage people from working hard to earn more. Thus, they may always find a way to avoid paying high tax rates.

The contradiction of indirect taxes

The difference between indirect taxes and direct taxes is distinguishable. In terms of direct taxes, you will have to pay directly to the government.

Whereas, when you are paying indirect taxes, you as a buyer pay for the tax that has been imposed on the seller.

Which situation is an example of direct taxation?

While understanding the concept of direct taxes, it is important to learn about the situation that can be an example of direct taxation.

As I broke it down earlier, direct taxes such as income tax, property tax, and taxes on assets are directly paid by the taxpayer. They pay this tax straight to the government.

So, simply, You pay your tax directly to the government. One thing you must remember is that you can never shift this tax to someone else.

Here are some common examples that will help you understand Which situation is an example of direct taxation.

Income tax

Income tax is probably the most well-known tax on the direct tax list. Businesses and individuals are responsible for paying a certain amount from their income.

This payment does straight to the government. Individuals and businesses are levied to pay a certain tax rate based on income levels.

Property tax

Homeowners and other business owners are responsible for paying the tax based on how many assets they own.

All the property taxes go to the local services, schools, and other local infrastructure.

Estate tax

The estate tax is imposed on an individual based on wealth and only applies to large estates.

Gift tax

The concept of gift tax is very similar to the estate tax. It is mainly applied to certain gifts given to individuals for the rest of their lives.

The effect of direct taxes on the cost of living

There is a chance that direct taxes can affect your disposable income. This disposable amount is the money left to spend or save after you pay the tax.

So, if your state has a high income tax rate, they may take a huge chunk from your paycheck.

Likewise, property taxes impact housing affordability. You may have a question by now: Which situation is an example of direct taxation that can directly impact overall housing costs?

Well, the answer is property taxes. If you live in an area where the property tax is high, you may have to pay a lumpsome amount for the tax. On the other hand, you will be left with a minimum value for your savings or expenses.

Direct tax is indeed necessary for all kinds of revenue collection. However, it also impacts the cost of living, bette economic growth, and other factors.

Balancing all the tax-related policies for better sustainable economic growth is important.

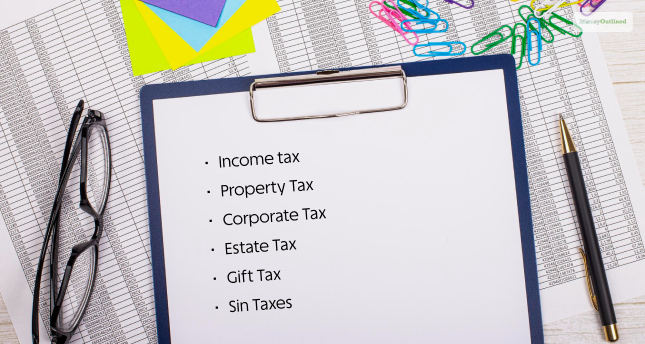

Examples Direct Taxation

In this section, we will be exploring different examples of direct taxes in the U.S.

Income tax

Income tax is the most well-known direct tax in the U.S. In the case of income tax, individuals are responsible for paying a certain amount from their income, which highly depends on their basic income.

According to the principles of income tax, if you have a high income, you are liable to pay a high income tax. This U.S. federal income tax system is very progressive.

However, it often leads to arguments due to the difference between income tax rates for high-income and low-income people.

Property Tax

House owners are liable to pay such taxes. Your property tax will always depend on the overall value of your properties.

Always remember that in the U.S., the amount you pay for the property tax is used for various public services such as schools, government institutions, and roads.

The property tax value is also used for emergency services.

Corporate Tax

Businesses are the main contributors to corporate taxes.

Imagine you have a manufacturing company with recent revenue of around $1 million. You currently have no debt, no amortization, or any kind of depreciation.

The direct tax will then be calculated based on the revenue earned before interest or tax depreciation.

Estate Tax

Even though direct taxes are not transferable, the estate tax is imposed on transferring a deceased person’s property.

In this case, the estate tax rate varies on the estate’s overall value. The relationship between the deceased and heir is also considered during the estate tax.

Gift Tax

The gift tax is often imposed on transferring gifts during an individual’s lifetime. So, if you are gifting someone money or an entire property, it will fall under the gift tax.

However, there can be exceptions and limitations to the total amount of gifts.

Sin Taxes

Certain taxes are imposed on specific items, which can harm mankind. The sin taxes can also comprise non-essential components, for example:

- Liquor tax: The customers pay for the taxes on all kinds of alcoholic beverages.

- Cigarette tax: Smokers are responsible to pay for the taxes that have been imposed on cigarettes.

- Other taxes: consumers also pay taxes for items such as gambling.

Conclusion

The taxes are one of the pieces from your cost-of-living puzzle. While you are planning about where you can live, you will also forcefully add the tax factor to your equation.

Try to balance the cost of living and taxation. This way, you can determine which situation is an example of direct taxation.

You need to remember that you can never transfer the direct tax to anyone you know or your acquaintance. So you need to consider it when you are planning for a cost of living. These taxes pay a pivotal role in government operations as well as public services.

Leave A Comment