Table Of Contents

- Best Way To Save Money For The Future

- 1. Understand Your Finances And Start Budgeting

- 2. Get Out Of Your Debts

- 3. Make A Designated Savings Account

- 4. Automate Your Savings

- 5. Automate Your Bills

- 6. Use The Envelope Budget System

- 7. Cut Back On The Rent

- 8. Cut Back On The Utility Bills

- 9. Take Up Any Side Hustle

- 10. Cancel All Unnecessary Subscriptions

- 11. Try And Fix Things Yourself

- 12. Think Before Splurging

- 13. Buy A Car When The Financial Quarter Ends

- 14. Designate A Day To Not Spend One A Month

- 15. Try Eating Home-Cooked Food

- The Bottom Line

- Best Way To Save Money For The Future

- 1. Understand Your Finances And Start Budgeting

- 2. Get Out Of Your Debts

- 3. Make A Designated Savings Account

- 4. Automate Your Savings

- 5. Automate Your Bills

- 6. Use The Envelope Budget System

- 7. Cut Back On The Rent

- 8. Cut Back On The Utility Bills

- 9. Take Up Any Side Hustle

- 10. Cancel All Unnecessary Subscriptions

- 11. Try And Fix Things Yourself

- 12. Think Before Splurging

- 13. Buy A Car When The Financial Quarter Ends

- 14. Designate A Day To Not Spend One A Month

- 15. Try Eating Home-Cooked Food

- The Bottom Line

Best Way To Save Money? Here Are 15 Of Them To Save Your Financial Health!

Saving money is a true challenge. Most of us struggle every day to save bits of money here and there. But how often do we succeed? Rarely, to be very honest.

But what if I tell you that it is actually quite possible for you to save money if you are just a bit more attentive? Saving money is not the issue. Cutting down the expenses is. We are accustomed to a life where spending money has become a major part of so much that a lot of people are clueless about how to put it under control. But worry not.

In this article, we shall discuss the best way to save money and under different circumstances. This way, you will know exactly when and how to spend, so you have quite a lot to save for retirement.

Best Way To Save Money For The Future

So, if you are looking for the best ways to save some bucks for the future, we’ve got you covered. Stay with me till the end, and I guarantee not to disappoint you.

These ways will seem impossible to follow at first. Quitting on old habits is something no one really talks about. But, if you plan to do it, stand your ground, and we shall help you in every possible way.

1. Understand Your Finances And Start Budgeting

One of the simplest calculations in life to save money is ? learning budgeting. If you have control over your own budget, you get full control over your expenses. But the question is, where do you begin?

Before you begin saving money each month, you need to come to a mutual understanding with your cash flow. This means you need to understand every bit of your income and expenses. This includes monthly bills, debt payments, and savings contributions.

How to create a budget:

- Keep a record of all your finances over a 30-day period. This will include your total income and all your expenditure.

- Compare how much you spend every month with how much you spend. This will help you understand if you are overspending each month.

- Separate your expenditures into variable and fixed costs. Fixed costs are the expenses that are generally tough to adjust, like utility bills or rent. Variable costs, on the other hand, are more adjustable expenditures like entertainment, groceries, and subscription services.

- Identify if there are any variable costs that you can easily cut back on. This will help you allocate more towards how much you get to save each month.

- Evaluate your progress every day. Make adjustments if needed. If this appears to be a bit overwhelming, there are a number of budgeting applications that make the whole process simpler.

2. Get Out Of Your Debts

Debts are your worst enemies. No matter how much you aim to save each month, if you have pending debts, saving is a far-fetched dream.

So, before you start saving, get out of your debts. The longer you wait, the more it becomes. Because of interest, the price you pay to borrow money becomes higher and higher over time. If you delay paying back debts, the accruing interest can easily wipe out any money you managed to save.

3. Make A Designated Savings Account

To save money faster, it is better to separate the money you need to spend every day from the money you wish to save. The best way to do this is to open a different savings account.

If you do this, you will reduce the risk of jumping into the savings fund to spend on everyday expenses. Rather, it inspires you to stick to what money you allocate for yourself every day. It is a great way to save yourself from the temptation of spending more.

4. Automate Your Savings

If you have a stable monthly income, think about automating the savings contribution every month. This means you can set up an automated transfer from your everyday spending account to your savings account every month. When you automate your savings, you further decrease the chance of using the funds for everyday expenses.

5. Automate Your Bills

When we are discussing this topic, it might just be worthy enough to suggest you automate your bill repayments. Companies very frequently charge you a lot of payment fees if you are not paying their bills on time. This is something you definitely need to avoid if you are planning to save money for the future. So, to avoid these fines, the money will be automatically transferred from your bank to the companies’ accounts.

Put a spending limit on your card.

Good thing I rarely even use my card. Credit and debit cards are the epitome of every broken situation ever. So, if you wish to save money, put a limit on the credit or debit card. This will make sure you are not overspending. There are many banks that offer this service. So, it is better if you can just run to the bank and question them about the same.

6. Use The Envelope Budget System

While this has recently become quite popular on TikTok, the envelope budget system has been there for quite a while. This means you take out cash every month from your bank and put it in designated envelopes.

Each envelope is named under a particular expense. And you can only spend the amount you allocate in the envelope each month. This is also one of the toughest ways to budget as you get the temptation to spend more each month or take money out from other envelopes in case there is a shortage of one. But refrain from doing so.

When you pay in cash, it is easier to remain within a limit whenever you pay for each expense type.

7. Cut Back On The Rent

Cutting back on your rent is another great way to start saving as much money as possible. If you live alone, the best way to do this is to get yourself a roommate. This will instantly divide your rent, and if you decide to live with two more roommates, you will pay hardly a fourth of what you pay at present.

So, if you are paying, let’s say, $1000 now, having four roommates will reduce the rent to $250. This is a huge saving, given you are deliberately trying to save up some money.

If you are already living in a shared apartment, try moving to a smaller room. This way you would have to pay a lot less in comparison to a bigger room. Rent rates vary depending on the size of the room. So, there is a good chance that you can make a major saving each month.

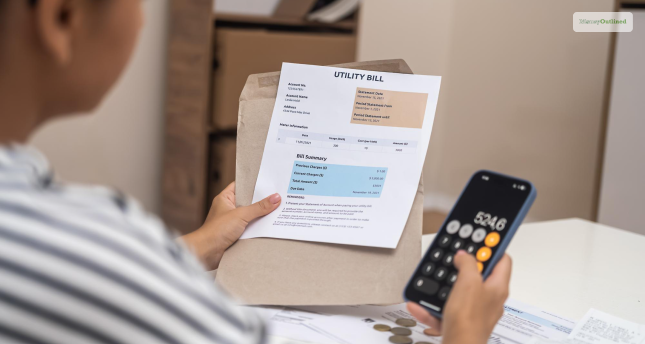

8. Cut Back On The Utility Bills

Another great way in which you may do some fast savings is to cut back on utility bills. Your gas bills and electricity bills make up for a huge amount of what you spend every month. So, if in any way you can reduce them, you may easily save yourself some extra cash.

Here is how you may do it:

- Change the energy provider. When you are on the most expensive tariffs in the market, you can save hundreds of dollars every month.

- Swap your usual light bulbs for LED bulbs. LEB bulbs can actually save 75 to 85 percent more energy in comparison to your regular light bulb. It will also last for 10 to 25 times longer.

- Invest in a smart thermostat. This will help adjust the central heating intelligently. Hence, it will potentially save you a good amount of money.

- Seal up any air leaks. Air gaps on your doors or windows increase electricity bills as heaters have to work more to keep the area warm. Sealing these gaps will make sure there is no air leak.

9. Take Up Any Side Hustle

If you are serious about boosting your monthly savings, it can be quite helpful to take up a side hustle. You could just work anywhere ? from doing evening shifts at the nearest pub or restaurant after your usual office job to doing gigs. There are a number of options open in front of you to make a choice.

This way, you can be assured that there is an extra cash flow in your account. But, if you are doing it, make sure you are transferring the entire money into your savings account. This way, you can keep yourself from spending the money unnecessarily.

10. Cancel All Unnecessary Subscriptions

You definitely do not need a subscription to every online platform that you have subscribed to. This is one of the most common ways these platforms earn money. Because once a customer subscribes, they are unlikely to unsubscribe again. If you ever get to think about it, you’ll realize the insane amount you may have paid to these applications when you do not even watch them on a regular basis.

11. Try And Fix Things Yourself

One of the best ways to make some massive savings is to try and fix things by yourself. Thanks to the reach of the internet, you can literally learn anything and everything from the internet. From stitching your clothes to fixing leaking pipes, you can do it all. So, if you see a small rip on your dress, you do not have to rush it to the tailor. You can just get it done yourself without any added cost.

12. Think Before Splurging

Surrendering to instant gratification is indeed the biggest villain of saving money rapidly. Before you make a major spending, give yourself some time to think first. This cools down the impulsive part of your brain ? the one that is desperate for some quick serotonin. Never ever let that part have control.

If you really wish to test yourself, keep at least a month’s gap between two major purchases. This will make sure that your impulsive buying habits are in check. It also gives you just enough time to find out if there is a better deal somewhere else.

13. Buy A Car When The Financial Quarter Ends

If you wish to get a great deal on a car, the best times to purchase it are ? June, September, December, and March.

This is because most car dealers have their target set for each quarter. While these targets are monthly or weekly, dealers get huge bonuses at the end of the quarter. This means you will probably get a better deal as the dealer will be keen on hitting their sales target.

Cut your grocery spending down.

If you are able to cut down on your grocery spending every week, you will see a visible change in how much you save each month. One of the most effective ways to do this is to plan out each of your meals beforehand. This means you can precisely calculate how much you need to spend before you go shopping.

An extra tip to consider is to quit meat once a week, as meat is usually a bit more expensive than vegan products or vegetables. This minor weekly saving will add up pretty much over time.

14. Designate A Day To Not Spend One A Month

To save a bit more money, make sure you have at least one day in a month where you do not spend at all. You will eat whatever you have at home. Apart from the fixed expenses, you will not spend one penny anywhere.

If you have nowhere to go, just sit at home and watch TV. It is a good way to pass the time.

Once you get used to this, things will become way easier, and you will save a lot of money bit by bit.

15. Try Eating Home-Cooked Food

If you ever calculate how much you spend each month on takeout, you will be shocked to your core. We tend to unknowingly spend way more than we can imagine on takeout. So, it is better if you cut down on the outside food and stick to whatever you have in the fridge.

Sell your unused things.

If you do not need it, just sell it. You absolutely do not need an old jumper that does not even fit you anymore. So, it is better to just sell it and get some extra money from it.

The Bottom Line

There is not one best way to save money. There are multiple. We have listed down quite a few of them. Now, it is up to you how effectively you are going to follow them.

But if you do, please leave a comment below and let us know how our tactics helped you in your financial journey.

Continue Reading:

Leave A Comment