Table Of Contents

- Key Takeaways

- How To Write A Check?

- Enter The Date

- Enter The Recipient's Name

- Write The Payment Amount In Numerical Form

- Write The Amount In Alphabetical Format

- Sign The Check

- Numbers Across The Check

- Route Transit Number

- Account Number

- Check Number

- How To Write A Check For Special Occasions?

- How To Write A Check To Yourself?

- How To Write A Check For A Wedding

- How To Write A Check Online

- The Bottom Line

- Key Takeaways

- How To Write A Check?

- Enter The Date

- Enter The Recipient's Name

- Write The Payment Amount In Numerical Form

- Write The Amount In Alphabetical Format

- Sign The Check

- Numbers Across The Check

- Route Transit Number

- Account Number

- Check Number

- How To Write A Check For Special Occasions?

- How To Write A Check To Yourself?

- How To Write A Check For A Wedding

- How To Write A Check Online

- The Bottom Line

How To Write A Check For Different Payment Types

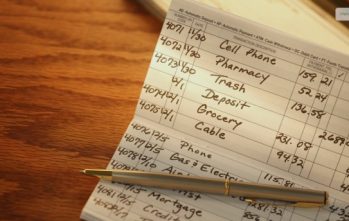

For those of you who are regular check payers, knowing how to write a check is as natural as breathing for you. However, if you are totally new to the business, it might confuse you.

It has been confusing for all of us at the beginning.

Although digital payment methods shadow checks, they haven’t gone totally obsolete yet.

There are many occasions where you are still required to pay by check. Hence you must always know the parts of a check and the easiest ways how to write a check.

Writing a check is easy and does not require learning rocket science.

Key Takeaways

- Thanks to digital transfers, paper checks are rare; however, you may still be in need of one.

- There are five mandatory steps involved in how to write a check.

- The pre-printed digits on a check help assure that the funds are going to the right place.

- If your checking account is lacking money while writing the check, it will bounce back and will be returned to the payee for having an insufficient balance.

- Endorse a check that is made out to you immediately.

How To Write A Check?

Do you want to know how to write a check efficiently? Worry not because I am here to help you exactly with that.

You must follow the following steps to write a check smoothly.

Enter The Date

At the top right corner of the check, you are supposed to fill out the date on the blank line. Based on United States standards, you are to follow the “month/date/year” format while filling out the date on a check.

This is an essential step as it informs the bank of the date when you wrote the check, which shows if the check is post-dated, which means it must be cashed on, or after the date mentioned on the check.

You must remember that the recipient of the check will not be able to cash the check if it is dated in the future. Banks will refuse to accept the check until the mentioned date has occurred.

Also, be careful while mentioning the year on the check. Banks only honor checks that are six months young or older; therefore, a check with the correct date and month but an incorrect year may not be accepted either.

Enter The Recipient’s Name

You may see a blank line just after “Pay to the Order of” written on a check. That is exactly where you are supposed to write the name of the recipient of the check.

This can be whoever the check is being issued to an individual, organization, business, etc.

If you are writing the check to an individual, make sure to write their first and last name, and in the case of an organization or business, you are to write its full name.

Make sure the name you are using is legible. Banks will confirm the identity of the recipient by comparing their photo ID with the name on the check.

If you are unsure about the correctness of the name, always double-check with the recipient, or else it might give rise to depository issues as banks are not obliged to accept nicknames or DBA names.

Write The Payment Amount In Numerical Form

If you know how to write a check, you will know where to write the amount you are paying the recipient. However, if you do not, the box that sits right next to the recipient’s name is where you are to fill in the amount you are supposed to pay.

Tip to keep in mind: fill the amount as close as the left side of the check as that prevents anyone from unethically filling in a new amount.

Even if the payment does not involve any cents, always add “.00” at the end of the payment number, as that will prevent fraud.

Write The Amount In Alphabetical Format

This is yet another step that you may be familiar with if you know how to write a check. But for starters, you are to fill in the amount both numerically and alphabetically.

The amount must also be expanded in a word format on the blank line just under the name of the recipient.

Well, you might be wondering how to write a check with cents. Well, in that case, cents are to be written in fractional forms and written in small sizes to make sure the entire amount can be written clearly, as that amount is legally recognized on the check that you write out.

Sign The Check

At the bottom right corner of the check, you must sign your name. It is mandatory, and no checks are allowed to get cash unless it has been signed.

Always double-check that you have signed the check with your full signature handing it out, or mailing it.

It is always suggested that you use the same signature across all your checks. Banks usually get suspicious of the authenticity of the checks if they see different signatures of the same issuer.

Although using different signatures is a great way of risk management, it will restrict seamless transaction processes in business as banks will constantly be holding your checks to investigate for their authenticity.

Numbers Across The Check

If you are planning on acing how to write a check, there are certain numbers across the check that you must be accustomed to.

The following is the number that you must know while writing a check:

Route Transit Number

It is the first numerical sequence that represents the routing transit number of your bank or financial institution. This code identifies with your bank hence allowing the check to get directed to the correct place for processing.

Account Number

Your unique account number is the second numerical sequence that is written on the check. You are assigned this number by the bank when you open the checking account for the very first time.

Check Number

A check number is the last set of numbers present in the check. You will also find it at the top of the check and right beneath the date. It helps you to track the payment if you need it later on.

How To Write A Check For Special Occasions?

However, there are special considerations where you might have to write a check beyond just writing it for business purposes.

Undermentioned are certain special occasions where you might have to know how to write a check.

How To Write A Check To Yourself?

Writing a check to yourself is legal and nothing complicated. All you have to do is put your own name as “Pay to the Order of,” and you can easily make payment to yourself using a check.

How To Write A Check For A Wedding

While writing a check for a wedding, make sure you write the maiden names of the couple

on the check. Also, try to write the name of both people. This will not only help either of the persons to go and cash the check but also looks good as it will be a gift for the couple and not just one person.

How To Write A Check Online

Writing a check online is nothing challenging. All you have to do is get your hands on an eCheck and fill out the account number of the issuer, the routing number, and the payment amount.

Lastly, click on “submit” to authorize the payee to withdraw the amount from your bank account. It is totally safe.

The Bottom Line

Now that we are able to pay through online methods, the use of paper checks has greatly reduced; however, you never know you are in need of one.

Hence, it is essential to know how to write a check so that you do not get stuck in any such emergencies.

Additionally, knowing how to write a check, along with endorsing it and depositing it is a fundamental part of your financial education.

Continue Reading:

Leave A Comment