Table Of Contents

How To Read A Check For Fraud: Red Flags To Watch Out For

Red flags involving fraud are undesired situations that continuously lead to abuse, waste, and, of course, fraud of resources. Whenever an investigator examines the stocks of a company, he might notice unusual characteristics. These are usually termed fraud red flags or factors that contribute to fraud.

Every organization has faced fraud risks, either internal or external, once in its existence. Irrespective of its nature, fraud might have an enormous impact on the agency. However, it is important to have an idea about how to read a check. If you want to dig deeper into the fact, this article is the one for you.

Red Flag Fraud Warnings One Must Look Out For

Every accounting and audit professional must look out for the red flags in a fraud check. Some of the most common ones are listed below:

1. Shrinkage In The Inventory

While moving stuff, it is common to lose a lot of things belonging to the inventory. However, excessive and unusual inventory shrinkage might be a warning you are experiencing fraud. It is the job of the auditor to identify such a shrinkage by having a look at the balance sheet, the products sold previously, etc.

They must further compare them with the previous projections as well as records. In some circumstances, the auditor might take into action unintended stock-taking randomly to identify an unexpected inventory record.

2. Several Payments Made At A Time

In several cases, the accounting department of a company deliberately processes fake payments to a service provider. The officers must be included if the mistake is not genuine and report it so that quick actions can be taken. They might also learn how to read a check number.

On the other hand, there are circumstances when an individual employee endorses duplicate settlements to fake as well as genuine agencies. It is the job of the audit and accounting team to notice any such unusual payment. Things might worsen if there are several settlements done at a single time.

3. Lost Documents

An industry might go through frequent reports of missing documents, including the ones which are extremely sensitive. But if the frequency becomes often, there is a need for you to be alarmed about fraud. Missing documents included in red flags are motor vehicle registration, checkbooks, a list of sales as well as purchases, etc.

When such a report disappears suddenly, it might point to an undesired situation. Keep your eyes and ears open before your organization loses its significant assets and doesn?t know how to read a check.

4. Frequent Grievances

Grievances about processes or personnel that take place often are not good news for the organization. When an industry faces endless complaints about an employee, it must not be considered as usual ordinary venting. Rather, there must be investigations conducted to detect the cause of the complaint.

Additionally, every employee must get training on how to read a check routing number. This will help them to take quick action whenever a malicious activity is detected.

5. Invoice Spikes

In its initial phase, a company might deal with a lot of spikes in invoices because it tries to create an identity in the market. But, it must ring a bell in your mind when the number of invoices is simply getting doubled.

Take, for instance, there are reports of unlisted payments or understated amounts and volumes, even if they are recorded. It is the sole responsibility of the organization to learn when spikes take place. They must also ensure that customer orders must be recorded daily.

6. Innumerable Adjusting Entries

Various accounting premises tend to produce multiple adjusting entries in the accounts book to cover the miscalculated money. For instance, some of these entries will comprise customer adjustments having a significant effect on the financial year-end results.

If you detect unnecessary adjustments that have been done without stating the reason might trigger employee fraud. However, you are on the safe side if you enlighten yourselves with how to read a check. An unusual entry in the financial account must have an explanation attached.

How To Read A Check From The IRS? Various Steps Included

Do you know that now you can read a check yourself? All you need to know is a few important details that are listed below.

Personal Data

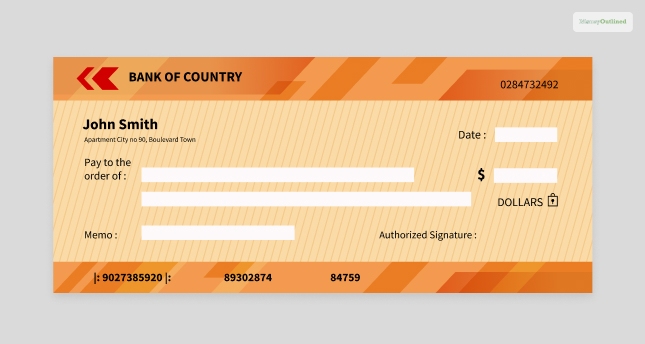

The left-hand corner, in the upper portion of the check, is where you find the personal information of the account holder. If you know how to read a check bank of America, you must have an idea that this section consists of their address and name.

Payee Line

The payee line is where you find a text reading ?pay to the order of.? It refers to the entity or person to whom you owe the said amount. If this particular check is sent to your name, then you become the payee. There might be a need to endorse this check by attesting its back when you are all set to cash it.

Dollar Box

When you have to locate the check amount in numbers, the dollar box is where you go. Suppose the check is worth $200; then you will have to write it in numerics in the dollar box. Knowing how to read a check for direct deposit is an advantage here.

Conclusion

I hope this article gave you an insight into how to read a check efficiently. If you want to discover more about the routing number but have no check handy, you can still find it by simply using the ABA routing number tool. Keep reading my articles if you want to dig deeper into check frauds and tips to read them.

Explore More:

Leave A Comment