Table Of Contents

Earnings Before Interest And Taxes(EBIT): How Does It Work?

Earnings before interest and taxes, or as we popularly call it, EBIT, is an indicator of the profitability of an organization. Businesses calculate EBIT by deducting all expenses from the revenue, including interests and taxes. EBIT is also known as the operating profit, operating earnings, and profit before interest and taxes.

If you divide EBIT by sales revenue, you may get an operating margin, which is expressed as a percentage. The margin is a comparison to the previous operating margins of the organization, the current net profit margin, or the margins of similar operating organizations within the same industry.

If you are looking for more information on EBIT, stay with me till the end of the article, and you shall get a detailed overview of it.

Key takeaways

- EBIT, or earnings before interest and taxes, measures the net income of a company before deducting interest and income taxes.

- EBIT also helps in analyzing the performance of the core operations of a company.

- It is also known as the operating income.

- EBITDA equals the earnings before interest, depreciation, taxes, and amortization while calculating profitability.

Let Us Understand Earnings Before Interest And Taxes

EBIT, or the operating profit, is the measurement of the profit that a company generates by its operations. By ignoring the taxes or interest expenses, EBIT helps identify the liability of a company to generate just enough earnings to remain profitable while at the same time paying for the debts and funding other ongoing operations.

EBIT does not fall under the GAAP metric and is not a label on the financial statements, but is reported as operating profit in an organization?s income statement. Operating expenses, which include the cost of goods sold, are deducted from the total revenue or sales. An organization may include non-operating income, such as income from investments.

A company can include the interest income in EBIT based on its sector. If the company has an extension of its credit to the customers as a vital part of the business, that interest income becomes a component of the operating income. If the interest income comes from bond investments, the business may then exclude it.

How To Calculate EBIT?

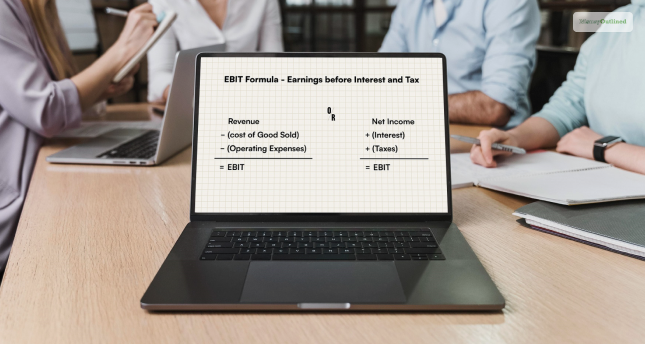

There are mainly two formulas that businesses may use in order to calculate EBIT.

The formulas go as follows:

EBIT = Revenue – COGS – Operating Expenses

OR

EBIT = Net Income + Interest + Taxes

Where,

COGS is the cost of goods sold.

The calculation of EBIT combines the manufacturing cost of the company. This may include raw materials and the total operating expense, including employee salaries. These items are deducted from the revenue:

- Hold the value for sales or revenue from the very top of the income statement.

- Deduct the cost of goods sold from the sales or revenue, which will give you the gross profit.

- Deduct the operating expenses from the gross profit to find out the EBIT ratio.

What Does EBIT Give Out To The Investors?

EBIT is an extremely useful element when comparing the performance of identical companies within the same industry. EBIT, however, is not a very efficient measure when it comes to comparing different sectors.

For instance, manufacturing organizations will have more COGS compared to service-only organizations. Organizations belonging to capital-intensive industries that have significant fixed assets on the balance sheet are usually financed by debts that incur interest expenses.

Investors use EBIR to theorize how businesses run without capital structure costs or taxes. It also helps level the playing field when the investors compare different companies that have different tax rates.

EBIT Vs EBITDA

EBIT is an organization?s operating profit before paying taxes and interest expenses. EBITDA, on the other hand, is the earnings before interest, taxes, depreciation, and amortization, which uses EBIT without the amortization and depreciation expenses when it calculates profitability. EBITDA also cancels out the taxes and interest expenses incurred on debt. But, there are certain differences between EBIT and EBITDA.

Organizations with a notable quantity of fixed assets may depreciate the cost of buying those assets over their useful life. Depreciation lets a company spread the cost of an asset throughout the life of the asset, which reduces profitability. For organizations as such, depreciation will impact their net income. EBITDA measures the profits of a company by removing its depreciation and reveals the profitability of the operational performance of a company.

What Is The Importance Of Calculating EBIT?

EBIT is an important business metric that is available in handy for multiple scenarios. For instance, when investors are buying an organization, the earning potential of the organization is a lot more vital than its existing capital structure.

Calculating EBIT may also help analysts or investors compare organizations within the same industry.

If an organization has a low margin, the EBIT analysis will determine if the low margin is the result of the performance of the company or if it is because the whole industry is facing a slowdown.

Other business metrics, such as ratio analysis, also depend on the inclusion of EBIT in their calculation. Creditors minutely monitor EBIT, which gives them an idea of the generation of pre-tax cash for paying back debts.

For industries that have a Free Cash Flow, EBIT acts as a proxy for those companies with a consistent capital expenditure. You need to keep in mind that Free Cash Flow is a vital output in business valuation.

Some of the other important reasons why you should calculate EBIT are as follows:

- EBIT is an indicator of operating efficiency.

- EBIT helps in analyzing the operating performance of a business.

- It helps investors determine the potential and profitability of a company.

- EV/EBIT ratio helps analyze the value of a company.

The Bottom Line

The EBIT full form, which is earnings before interest and taxes, helps measure the profitability of a company. Businesses calculate the EBIT by deducting expenses like interest or tax from the revenue.

EBIT is also known as the operating profit. It helps investors compare the performance of all the identical companies that operate within the same industry; however, it may not be as efficient when it comes to companies that operate across different industries.

Read More:

Leave A Comment