Table Of Contents

What Is Check Register: The History And Evolution Of Check Registers

Nothing is more advantageous for both banking customers in a bank and an individual than a check register. It helps in tracking the money of the bank account holder and other transactions in a limited period of time.

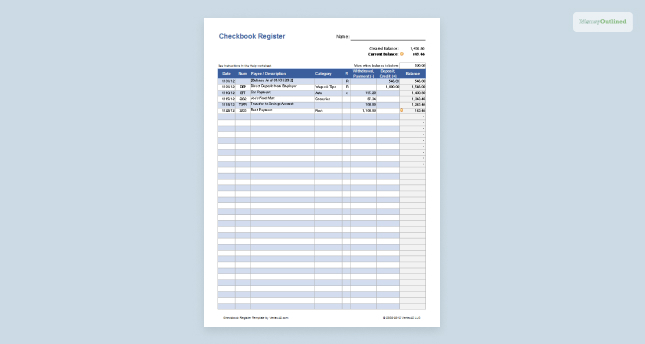

In simple terms, check registers are also known as financial accounting journals, where cash disbursements are calculated. It refers to a ledger-type accounting tool that keeps track of payable documents.

More or less like an accounting spreadsheet, the check ledger optimizes columns to calculate dates, payee, and check numbers. In this informative guide, you are going to discover some interesting facts about the check register. So, continue reading.

History And Origin Of The Check Register

The simplest check register definition dates back to centuries when there were green-visored accountants. They recorded money arriving and exiting with the use of a quill pen in a business?s general ledger. This was the time when the register could be operated in a number of functions and structures:

- It might be paper-based, where credits and debits were inputted into the common ledger with a pencil or pen.

- It lies in the checkbook of an individual, again input with a pencil or pen.

- It might be a possibility as a computer document, generally an Excel-like or accounting spreadsheet.

- It can also appear on a mobile app such as Balance My Checkbook and/or My Check Register.

- Finally, it can be from a digital accounting ledger software package, including Freshbooks, Sage Intacct, or Quickbooks Online.

A Check Register: Benefits Attached

You might wonder why would you want to use a check register? Check out its benefits here:

Gaining Economic Transaction Data Quickly

Irrespective of which type of register you use for your checks, it provides the ?exhale? factor to the end user. Moreover, he/she can find out when the check hits an account as a payee or a payer. A check register eliminates all needs of waiting or wondering as the payment is locked and carried out in a confidential order.

It Consists Of Each Payment Method

The check register records almost all payment types, such as cash, wire transfers, checks as well as digital payment solutions. PayPal, Venmo, and also ATM transactions are included here.

Helps In Budgeting Better

It doesn?t matter whether you are managing a household or a business of your own. A check ledger is helpful as a financial playbook that records all your money that has been rolling in and out of the bank. The knowledge of what is a check register and how it works is beneficial when you want an organized way of budgeting.

Payment Records

Having a payment or an official record is quite beneficial for making sense of your economic standing. It is a complete record of all payment and transaction history, like who received the payment and when. The payment history offers you a better idea of your complete financial status. Also, it leads you toward better financial decisions.

Steps To Acquire Check Registers

Do you want to know how do you complete a check register? Here are some steps that will help you out in the process.

- One might request a registered check from your financial institution. They generally come with a checkbook. Your bank might also hook you up with a digital check register they possess. This will generally be included in the bank?s online banking personal package.

- Secondly, you can scroll online. Google provides a beneficial check register that is accessible easily through Google Docs.

- You might also acquire a check register from a primitive checkbook. Or a physical checkbook might help you in this case.

- Through a digital spreadsheet. You might design your personal checkbook register online by using a decent spreadsheet tool.

Check Registers Serving Different Purposes

- For Individuals:

For regular residents, the checkbook register is an amazing way of tracking all their expenses as well as income. In fact, the fashion is quite affordable too. These registers monitor an ongoing balance through a banking checkbook. It is a classic checkbook register example, showing the procedure’s easy for individuals.

If you use the conventional checkbook, you will be engaged digitally. However, you have complete control over the data you have collected in the register. On the other hand, if you opt for digital consumer banking software, you can still control it but with a bit of technology.

- For Small Enterprises:

Small enterprises face an increasing demand for a clear general ledger provided the modern commerce complexities. This refers to a record book where your credits and debits are tracked in real-time. A check register has a lot of other benefits for small business owner who wants to track all their expenses in a streamlined manner.

Brand owners might make use of a checkbook register to record all financial transactions without the need to hire an accountant. Moreover, they can maintain a precise account balance checking and dedicate their time to other significant processes.

If you have a small business and want great check management, ensure to get one with ample room for filling the registered items.

Summing It Up

Differentiate between your expenses and savings in just a simple step. Get a register and maintain your progress. The best part is you can check how much money you can spend in your professional checking account.

So this was all about the check register, its history, and the benefits it offers. Make sure you take note of it and start maintaining a checkbook register to maintain your expenses rightly.

Use the comment section below and let us know what?s your take on this! Thank You for reading.

Explore More:

Leave A Comment